Six Key Provisions of the Tax Bill Affecting Higher Education

Graduate Students, university community taking action on bill as Senate nears vote

As Congress moves forward on passing a new federal tax bill, Will Barclay doesn’t have to look far to see the consequences for some of the proposals affecting higher education. One provision under consideration would tax graduate student stipends, and if passed, that will lay a crushing tax bill on him.

“Quite simply, it would immensely increase my taxes,” said Barclay, an immunology graduate student who serves as director of advocacy for the Graduate and Professional Student Council (GPSC).

“Quite simply, it would immensely increase my taxes,” said Barclay, an immunology graduate student who serves as director of advocacy for the Graduate and Professional Student Council (GPSC).

“It would have added about $50,000 to my taxable income per year over the first three years of my program -- meaning I would have had to pay taxes on roughly $250,000 - just for the first three years -- when my living wages are comparable to Duke's minimum wage.”

The graduate stipend tax is part of a version of the bill that passed the House of Representatives earlier this month. However, it is currently not part of the bill under consideration in the U.S. Senate.

Graduate students and the university leadership are working hard to ensure that and other provisions in the House bill don’t go any further.

In a Nov. 14 email to the Duke community, President Vince Price outlined the six most concerning features of the House bill.

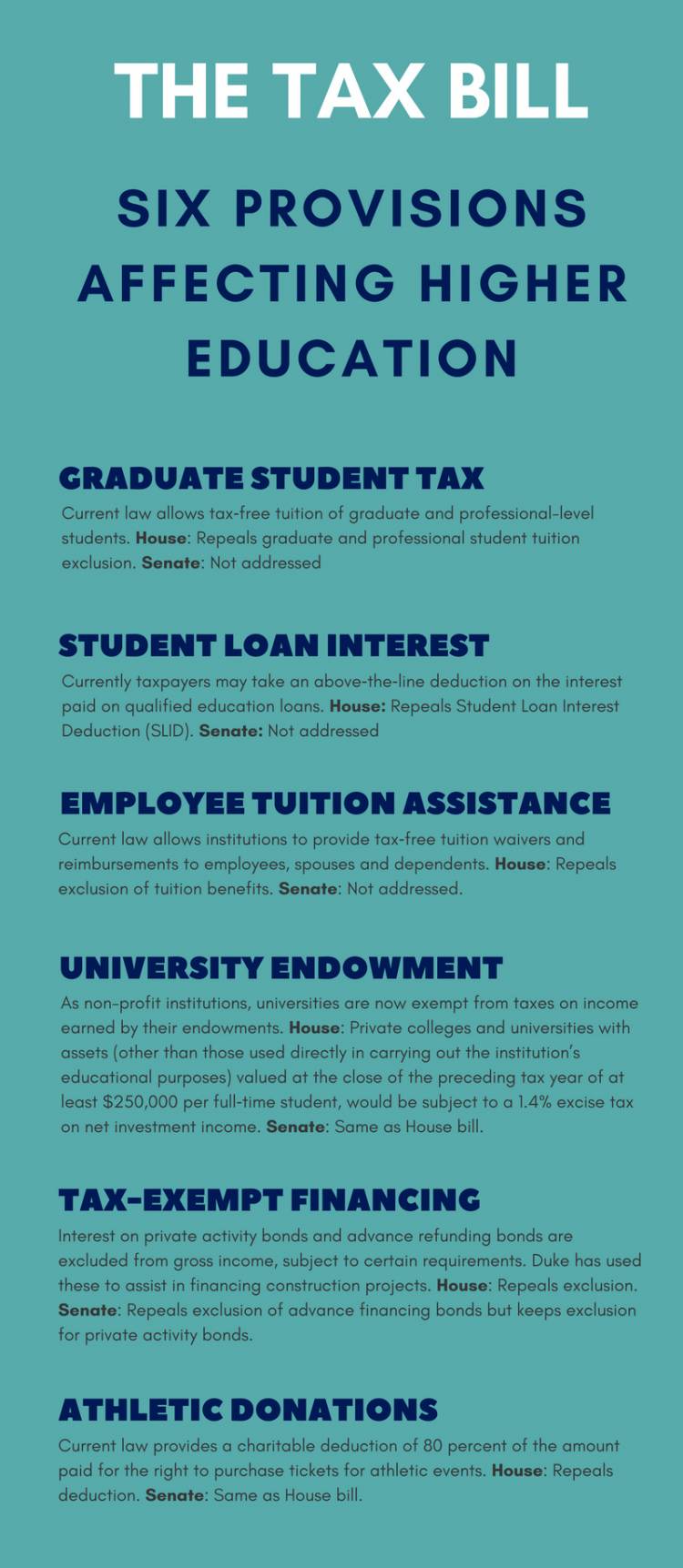

They are:

- Eliminating the deduction for interest in student loans

- Making graduate student tuition waivers count as taxable income

- Eliminating tax exemption for tuition assistance for employees and dependents

- Eliminating tax-exempt financing for construction projects

- Initiating an excise tax on university endowments that will reduce the amount of funding available for student assistance and faculty chairs

- Eliminating deductions for certain contributions to athletics programs.

Price said Duke officials are working to protect Duke students, staff and faculty from additional tax pain. “We believe these provisions directly threaten Duke students, employees, and their families,” Price said in his email message. “That's why we are working closely with other universities, national organizations and members of Congress to refocus the tax reform debate on simplification and incentives for education and research.”

Since then, Price has written to members of the North Carolina House and Senate delegations asking for the representatives to protect higher education. Chris Simmons, associate vice president for government relations, has been in regular touch with political leaders and their staff members.

But some of the most important work has come from Duke students and staff themselves in reaching out to Congress, Simmons said.

“Every student I’ve met I’ve encouraged to speak up,” Simmons said. “They need to be calling Sens. Burr and Tillis and thanking them for keeping the stipend tax out of the bill and ask them to keep it out of the final bill. And I’ve been very pleased at how they’ve been stepping up.”

Barclay said the GPSC advocacy office has coordinated several discussions between Duke graduate students and those at other universities as well as working with the national graduate student advocacy association. The results include a strong social media campaign and national petition.

As bad as the graduate student stipend would affect Barclay, he realizes there are many other graduate students in more precarious situations. If passed, he said there is little question it will close the door to graduate education for some low-income students, at a time that outreach to those students is more important than ever.

“The most dramatic effect would be felt by students from low-income groups, and those that accumulated a significant student loan burden prior to coming to graduate school,” Barclay said. “In addition to the inclusion of tuition waivers as taxable income, the proposed changes in [the House tax bill] also remove tax deductions for interest payments on student loans -- hitting these students from both ends, to unfortunate effect.”

Barclay and Simmons see hope that the Senate will reject the most onerous of the House provisions. Neither the graduate student stipend or the tuition assistance programs are taxed in the current version of the Senate bill. The Senate bill also doesn’t tax deductions for student loan interest. If passed, the Senate versions would be reconciled with the House bill for a final vote in both chambers.

Duke is concerned about all of the provisions affecting higher education in the House bill, but Simmons said the priority is protecting graduate stipends and the tuition assistance programs.

“There are many things in the House bill that are concerning and will have immense fiscal implications, and we are pushing back on all of them,” Simmons said, “But the first thing out of my mouth in talking with political leaders is this hurts people who are paying for college, whether it’s graduate students or employees. Increasing taxes on people who are paying for college is not a great policy to support.”

The Senate bill currently does include the proposed excise tax on university endowments and the elimination of deductions for some athletic department contributions. If passed, both would have significant repercussions for the university’s finances that would trickle down to financial aid and athletic scholarships.

Beyond the direct effects, Simmons also sees a larger tension ahead if the bill’s tax cuts further a two-decade-long squeeze of federal discretionary spending.

“The argument we’ve always been able to make is that federal support that goes into American higher education makes the country stronger and the economy healthier,” he said. “But discretionary spending is where higher education gets much of its resources for student aid and research. If that funding is used to pay for tax cuts, this will have implications for higher education spending in the future.”