How to Simplify Retirement Investment Decisions

Target Date Funds automatically rebalance stocks and bonds as retirement draws near

Nancy Mace, 51, was looking for a simple investment strategy for her retirement savings.She contributes regularly to her 403(b) retirement account and occasionally reads her quarterly statements but is uncertain about if and when she should change investments.

"I've always been adept at math, but stocks confuse me," said Mace, a grants and contracts administrator for Hematology Research at Duke. "I don't know if I should change anything, so I do nothing."

Read MoreMace found a way to feel more comfortable about investing after a seminar on Target Date Retirement Funds during Financial Fitness Week in May. These funds take much of the guesswork out of investing by creating a mix of stocks and bonds that automatically becomes more conservative as the investor approaches retirement or any other specified "target date".

Duke began offering Target Date Funds and other asset allocation options in 2011 as part of a simplified, three-tiered approach to investing.

"While choice is a good feature to have in a retirement plan, the multitude of options from Duke's retirement vendors can be intimidating," said Sylvester Hackney, associate director of benefits at Duke. "Target Date Funds and the tiered system simplify the options."

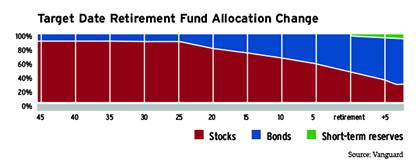

Research shows that the distribution of money between stocks and bonds is a crucial decision for an investor's long-term success, said Gary Gamma, a Vanguard representative who presented the Financial Fitness Week seminar on Target Date Funds.

"The more you invest in stocks, the bigger your opportunity for big gains and for big losses," Gamma said. "But as you get closer to the time you'll need the money in your 403(b), you want to lower your risk. Target Funds make that rebalancing process automatic."

For example, someone who expects to retire in 2040 might invest now in a 2040 Target Date Fund. This option would begin with 90 percent of an employee's money invested in stocks and 10 percent in bonds. This mix takes advantage of the long-term growth opportunities stocks bring. By 2035, five years before retirement, the fund will have automatically shifted to approximately 40 percent in stocks and 60 percent in conservative investments such as bonds. This lowers the risk of large losses just as the money is needed for withdrawal, Gamma said.

Target Date Funds are included in Tier 1 of Duke's three-tiered system of retirement fund choices. Tier 1 offers the option of choosing one fund for all 403(b) investments. Employees who want more variety can choose from core stocks in Tier 2, which includes approximately a dozen "best in class" stocks and bonds from each of Duke's four retirement vendors. Tier 3 includes several hundred other funds offered by Duke's retirement vendors.

Gamma, the Vanguard representative, said Target Date Funds are not for everyone. "If you like being hands on with your money, this is definitely not the fund for you," he said.

Mace left the seminar intrigued with the idea of a Target Date Fund as an opportunity to invest with confidence but not spend a lot of time thinking about it. She's setting up a time to speak with her fund manager.

"These target funds seem right up my alley," she said. "Now all I have to do is figure out how many more years I want to work before I retire."